Article originally posted by Brendan Gallagher.

The second quarter of 2022 was extremely rough for markets, giving investors a grueling bear market ride over the last few months. Driving the losses were stubbornly high inflation, rising interest rates, and recession concerns.1

However, there might be some hope ahead, if you’ll keep reading.

Let’s take a look at how markets performed and what we might look forward to in the months to come.

Looking Back – How did markets perform last quarter?

S&P 500 |

NASDAQ |

DOW 30 |

|

-16.45% |

-22.44% |

-11.25% |

|

The broader U.S. market sank on interest rate and economic concerns.1 |

The tech-focused NASDAQ was clobbered by higher interest rates and pricey valuations.2 |

Blue chip stocks also dropped in Q2 along with the broader market.3 |

Looking Ahead – What could we see 6-9 months ahead?

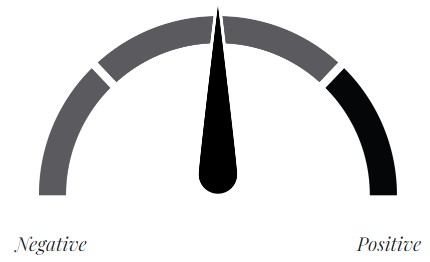

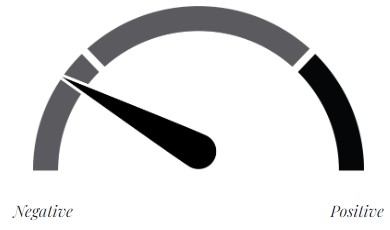

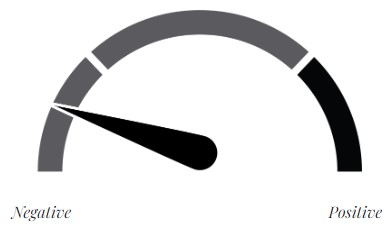

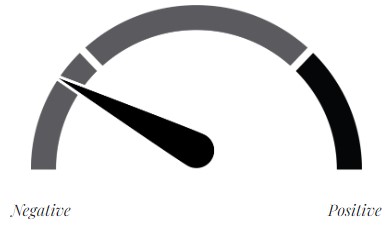

These are challenging times to make predictions about the future. The following gauges represent a forward look at what some analysts think we might see over the next few months. Since a simple projection can’t represent all opinions or probabilities, we’ve highlighted risks and opportunities for each.

U.S. Economic Outlook |

Equity Outlook |

Consumer Sentiment |

|

|

|

|

|

Risks: High inflation, interest rate hikes, and ongoing geopolitical and supply chain issues could tip the U.S. into a recession. |

Risks: Uncertainty about interest rates and the economy are likely to further weigh on markets. |

Risks: High prices and recession worries could dent confidence. |

Monetary Policy |

Geopolitical Risk |

Inflation |

|

|

|

|

|

Risks: The Federal Reserve may raise rates too high, too fast, triggering a “hard landing” by slowing growth too much. |

Risks: War, death, and economic disruption in Ukraine may continue, causing continued uncertainty and damage. |

Risks: High inflation could persist, changing consumer spending patterns and pushing the Fed to raise rates aggressively. |

“Exiting markets during a downturn might be appealing, but you risk missing out on future growth.”

Bottom Line – Critical takeaways for savvy investors

Raise your hand if you’re unsure of what could happen in the coming months.

Is your hand up? So is mine.

Markets and the economy face a confusing barrage of tailwinds (positive) and headwinds (negative). We don’t know which will prove stronger.

There’s quite a bit of hope ahead: we have a resilient economy, the jobs market remains healthy, and stocks could bounce back if inflation and interest rate hikes stabilize.

Bear markets are rough, but exiting a strategy now could cause long-term damage to your wealth if you miss the recovery.

What’s challenging is separating our emotions from analysis of what might be coming (especially when we’re in murky and uncharted waters).

Here’s an analogy:

Have you ever been whitewater rafting?

Imagine us in a raft, navigating a complex class IV rapid called “Scary Bear.”

It’s got huge waves, big drops, hidden rocks, fallen trees, eddies, currents, hydraulics, and more.

We’ve also got a crowd of folks on the banks jumping up and down, hooting and hollering, and yelling advice.

“Go left!”

“Go right!”

“Don’t fall out!!”

“WATCH OUT FOR THE BIG ROCK!!”

If we listened to everyone’s instructions, our raft would end up pinballing between rocks, spinning around in circles, and possibly even flipping over.

So, what do we do?

We read the river.

We develop a strategy that allows for a lot of flexibility in tackling the rapid.

We listen to our guide (that’s me) and paddle together.

We also remember to relax and remember why we’re here. That’s the hard part. It’s not always going to be easy paddling in smooth waters.

We’re facing A LOT of uncertainty this year, and it’s not likely to resolve into certainty any time soon. Like professional economists, we’re looking at the data and making careful adjustments.

Times like these favor flexibility, resilience, and a focus on long-term goals.

Bottom line, I’m reading the rapids, adjusting as conditions warrant, and I’ll be in touch when needed.

Questions? Please reach out. I’d be happy to chat.

Brendan Gallagher, CFP®

774-284-4769

bgallagher@pinnacle-llc.com

Sources:

2 https://www.cnbc.com/2022/06/29/stock-market-futures-open-to-close-news.html

5 https://www.blackrock.com/us/individual/insights/taking-stock-quarterly-outlook

U.S. Economic Outlook, Equity Outlook, Consumer Sentiment, Monetary Policy, Geopolitical Risk, and Inflation gauges: https://www.cnr.com/insights/speedometers.html (July 2022)

The S&P 500 is a stock index considered to be representative of the U.S. stock market in general. The NASDAQ Composite Index is an unmanaged composite index of over 2,500 common equities listed on the NASDAQ stock exchange. The Dow Jones Industrial Average is a price-weighted index that tracks 30 large, publicly traded American companies.

All index returns exclude reinvested dividends and interest. Indices are unmanaged and cannot be invested into directly.

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This content may contain projections, forecasts, and other forward-looking statements that do not reflect actual results and are based on hypotheses, assumptions, and historical financial information. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.