Even though many people have never heard of the term “dollar-cost averaging,” most of us are already doing it. If you have a 401(k) or similar retirement plan where a percentage of your paycheck is automatically withdrawn and invested into that plan, you’re already dollar-cost averaging. That’s because you’re investing the same amount of cash every pay period like clockwork.

With the goal to “buy low and sell high,” most investors find it difficult to predict how the market will move in the future. The idea of dollar-cost averaging is to invest your money in a stock, ETF (exchange-traded fund), or other security in equal portions over time. By spreading out your larger investment into smaller quantities, you avoid an unfavorably timed, lump-sum decision, which reduces market timing risk.

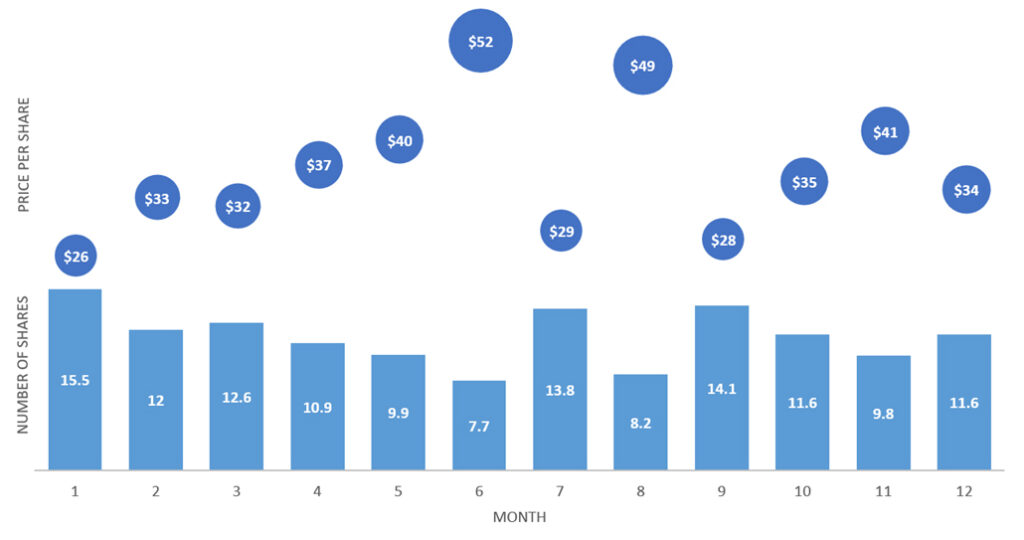

We’ll use Carl as an example to better understand how dollar-cost averaging works. In order to get started in, there are three choices you have to consider: the amount, the frequency, and the location. Carl holds a long-term investment horizon and plans to invest a fixed dollar amount of $400 on a monthly basis. After one year, Carl invested $4,800 total with an average purchase price of $36.33. With his fixed investment of $400 per month, he was able to purchase more shares when prices fell and fewer shares when prices rose, benefiting him with a lower average cost per share of $34.89.[1]

With any type of investment, there comes a certain level of risk. Dollar-cost averaging can underperform lump-sum investing at times; however, it aims to reduce market timing risks and accommodate the fear of missing out. With dollar-cost averaging, you don’t need to agonize over whether you should buy right now, wait for earnings, or wait for the market to dip. The goal is to stick to a long-term schedule of periodic purchases to reduce the fear of not buying or selling at the “right” time.

I have built my career as a trusted financial advisor by guiding high-net worth domestic and international clients to meet their financial goals. If you are interested in learning more about dollar-cost averaging or would like to meet with a financial advisor to review your current financial plan, please contact my office.

Written by:

Rosalie Schlaen, CFP®, CIMA, CRPC®

First Vice President – Investments, International Client Advisor

[1] Furst, D. (2020, December). Indecisive?… Try Dollar-Cost Averaging. Portfolio Perspective. Retrieved September 2021.